Banking

Secure banking access—without compromise

From branch employees to third-party processors, financial institutions are under constant threat.

The Mammoth Enterprise Browser protects banks and fintech organizations by enforcing Zero Trust at the point of access—without impacting performance or user experience.

Banking is under attack—and the browser is ground zero

Financial institutions face:

- Phishing and credential theft

- GenAI-assisted fraud and insider threats

- Legacy apps accessed from unmanaged devices

- Unsecured browser sessions used by remote employees and vendors

That’s where data breaches, wire fraud, and Zero Day attacks originate.

Mammoth shuts it all down—inside the browser.

The Mammoth Solution

Enterprise Browser for Financial Services

Every banking session—from internal dashboards to cloud CRMs—is wrapped in a secure, governed browser environment:

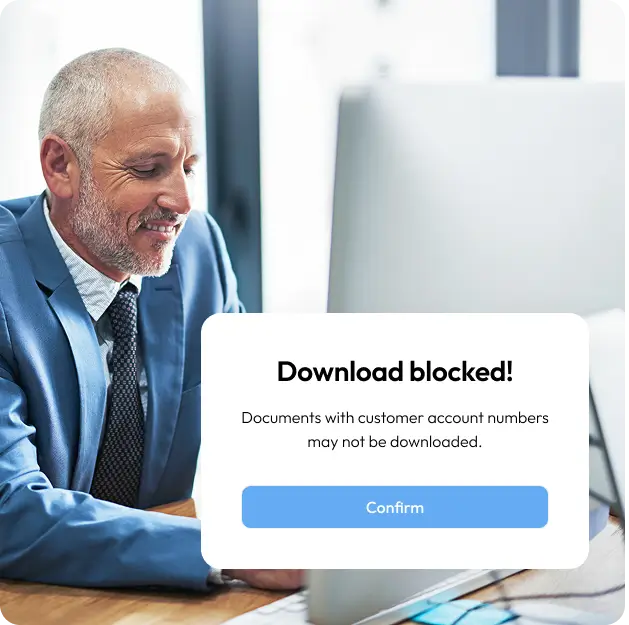

No downloads, copy/paste, or printing without permission

Block GenAI tools from being used to upload or extract sensitive data

Record and watermark sessions for auditing and fraud investigations

Restrict access based on user, device posture, and location

Allows secure copy and paste within the trust circle for seamless collaboration

All with no endpoint agents, no VDI, no infrastructure drag.

Stay compliant with FFIEC, PCI, SOX, and GLBA

Mammoth provides full observability, control, and audit readiness:

- Role- and context-aware session policies

- Session recording with time-stamped logs

- Real-time alerts for policy violations or risky behaviors

- Seamless integration with SIEMs and fraud analytics platforms

You meet compliance standards—while keeping teams fast and agile.

Built for every corner of the bank

Branch staff

Access customer data securely from shared or personal devices

Call centers

Granular policy enforcement for high-volume environments. Obfuscate sensitive data displayed on-screen to prevent visibility by CSRs

Risk and audit teams

Full session observability and forensics

Third-party vendors

Limited, trackable access with no VPN or laptop provisioning

Executives & traders

Browser-level DLP without slowing performance

Use Case

Securing remote treasury operations for a regional bank

A mid-size regional bank needed to provide secure, compliant access for treasury analysts and vendor partners during a core system migration.

With Mammoth, they:

- Enabled Zero Trust browser access for internal and external users

- Blocked clipboard access and unauthorized downloads from internal apps

- Monitored all sessions for risk anomalies and compliance audits

- Eliminated reliance on slow, costly VDI infrastructure

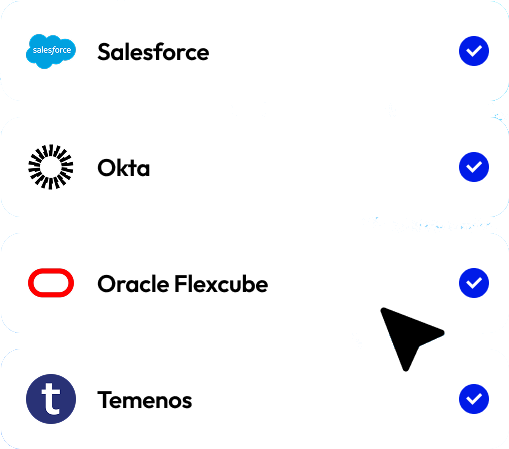

Works with your banking tech stack

Mammoth supports the systems you already use:

- Salesforce Financial Services Cloud

- FIS, Fiserv, Temenos, Oracle Flexcube browser-based access for both customer-facing online or internal banking operations.

- Internal web portals, custom dashboards, and cloud-native fintech apps

- Works with existing IdP/SSO: Entra ID, Okta, Ping, OneLogin, Google, Optimal, generic SAML2

Works with your banking tech stack

Mammoth supports the systems you already use:

- Salesforce Financial Services Cloud

- FIS, Fiserv, Temenos, Oracle Flexcube

- Internal web portals, custom dashboards, and cloud-native fintech apps

- Works with existing IdP/SSO: Entra ID, Okta, Ping, OneLogin, Google, Optimal, generic SAML2

Ready to secure every financial workflow— at the browser level?

Let us show you how leading banks and fintech organizations are modernizing secure access, reducing fraud, and meeting compliance—all with Mammoth Enterprise Browser.